Healthcare Startups Win More Investors with Branding

Healthcare startups are a risky investment. The US healthcare industry exceeds $1.6 trillion[1] in annual revenue but startups in the industry have low success rates. Venture capitalists are looking for high projections of ROI and for good reason. Half of digital healthcare startups will fail within the first two years.[2] And with a 90% failure rate projected among biotech startups,[3] investors have a lot of lost bets to cover.

It’s a long road to commercialization

Since the healthcare industry is so heavily regulated, healthcare startups may require significant peer reviews, independent testing and clinical trials of products, technology and services before reaching capitalization.

In the medical device industry for example, it takes a new product an average of 7.5 years to reach an M&A deal when investors can really see a profit.[4]

The investor’s left brain

Investors are looking for ROI above all. Data is critical. Healthcare startups typically allocate a lot of time and resources for research into market, competition, pricing, operating costs and sales projections.

That’s critical, but venture capital is an emotional investment and people don’t invest solely on data — just look at the stock market. Passively indexed funds outperform managed funds 84% of the time.[5] Why does the human brain not make smarter investment decisions than an indexed sample? The answer to this question could determine whether a startup is bought into or passed by.

The investor’s right brain

Managed funds underperform the market because we make emotional decisions about investing. Investors in a healthcare startup are passionate beings. They love a good story. They love a visionary. But startups have to make the vision shine. That’s where branding comes in.

“A brand is a voice and a product is a souvenir.”

-Lisa Gansky

Healthcare startups need to look, walk and talk in a way that makes their vision shine. Lisa Gansky has the right idea—perception often trumps reality. Clinicians understand this well, as they see the placebo effect consistently.

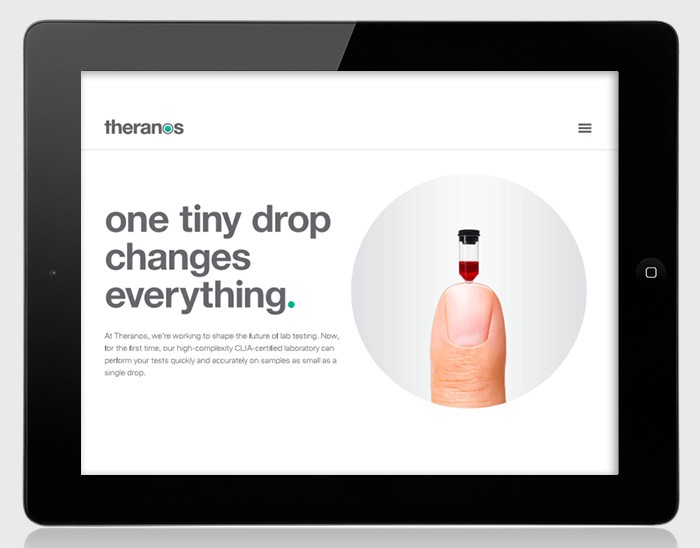

The brain of Theranos

To see how much influence branding can have on the healthcare investor, look at Theranos, the health technology company that rocked the diagnostic testing world when they claimed to have technology to run blood testing from a single drop of blood.

Theranos attracted investors like moths to a flame with a brand story that promised to change the world and a website that looked like Apple.com. In fact, Founder and CEO Elizabeth Holmes was such a devotee of branding guru Steve Jobs that she wore his signature black turtleneck to all media appearances.

Early investors in Theranos, along with high profile partners such as GlaxoSmithKline, Pfizer, Cleveland Clinic, and Walgreen’s, were so seduced by the company’s brand story they neglected the left-brain rigor typically focused on new healthcare technology.

It was not until Theranos approached the Department of Defense about using its testing that the government took a hard look at the product.[6] Due diligence unpacked a series of revelations, including a report that the company had discovered its Edison blood testing machines did not function accurately enough for clinical use. Instead, the company had secretly been using its competitor Siemens’ equipment to run tests.

While Theranos is now falling apart due to its neglect of the left brain — even long-time loyalist Walgreens has now sued the company for damages[7] — there is a positive lesson for startups as well.

Key Takeaways

Don’t neglect the testing rigor, trials, and data your healthcare startup needs to meet industry standards and appeal to the left brain of the investors.

Do entice the investor’s right brain. Investors want a great story. They want to fall under the spell of a visionary. Is your brand aiming that high?

- http://www.statisticbrain.com/health-care-industry-statistics/

- https://newsroom.accenture.com/news/half-of-healthcare-it-start-ups-will-fail-within-two-years-of-launch-accenture-finds.htm

- Freakonomics® of factors that determine failure of a biotech company, M. Kengatharan, Ph.D., M.B.A., QB3

- Venturesource, press releases, conversations with life science experts.http://qb3.org/sites/qb3.org/files/QB3Podcast20120521_6.pdf

- http://www.usatoday.com/story/money/personalfinance/2016/03/14/66-fund-managers-cant-match-sp-results/81644182/

- http://www.vanityfair.com/news/2016/09/elizabeth-holmes-theranos-exclusive

- http://www.wsj.com/articles/walgreens-seeks-to-recover-140-million-investment-from-theranos-1478642410